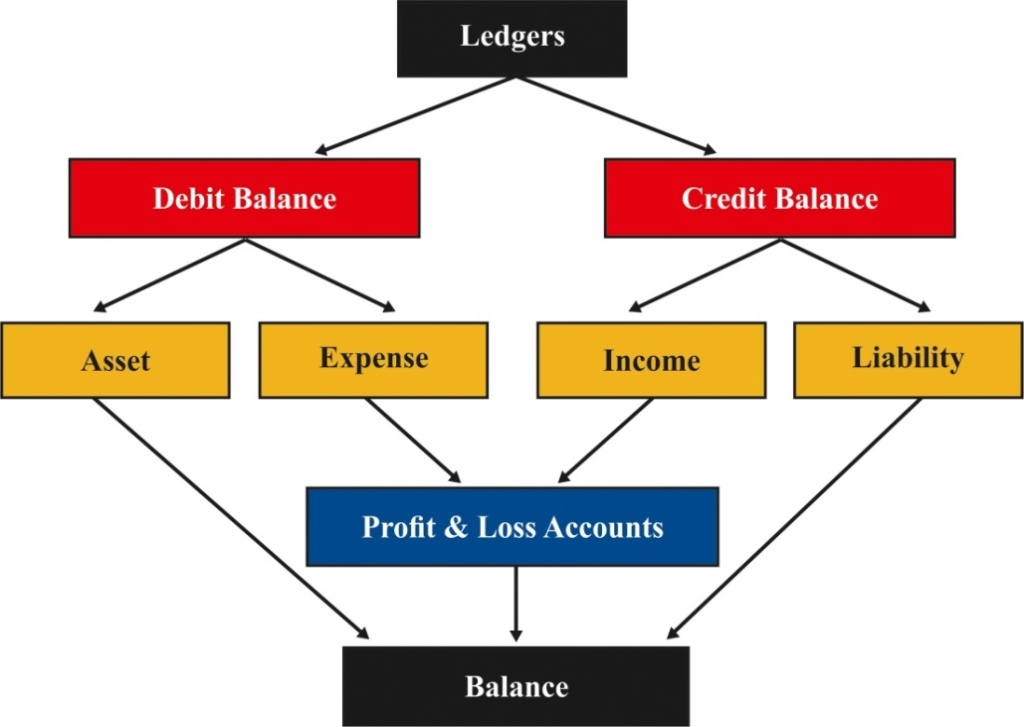

In accounting there are three types of ledger accounts, i.e. Personal, Real and Nominal. But as far as Financial and Accounting Systems are concerned, ledgers may be classified in two types only, those are;

- Ledger having Debit Balance and ledger having Credit Balance

Types of Ledgers

Why Accounting software does not recognize any ledger as personal, real or nominal, instead it recognizes it as an Asset, Liability, Income or Expense Ledger?

- Basic objective of accounting software is to generate to two primary accounting reports, i.e. profit & loss Account and Balance Sheet. Income and expense ledgers are considered in profit & loss Account and Asset and liability ledgers are considered in Balance Sheet. Hence every ledger is classified in one of the four categories, i.e. Income, expense, Asset or liability.

- Difference between Total Income and Total expenses, i.e. profit or loss as the case may be, is taken to Balance Sheet. So everything in accounting software boils down to Balance Sheet. Balance Sheet is the last point in accounting process.

- Any ledger can be categorized in any one category only, i.e. Asset, liability, Income or Expense. It cannot be categorized in more than one category.

- Ledger grouping is used for preparation of reports, i.e. Balance Sheet and profit & loss Account.

Grouping of Ledgers

There are four basic groups in Accounting, i.e. Income, Expense, Asset, Liability.

There may be any number of sub groups under these four basic groups. Grouping is important as this is way to tell software what is the nature of the ledger and where it is to be shown at the time of reporting.

Example: Cash ledger is an asset ledger and should be shown under current assets in Balance Sheet. If we group cash ledger under indirect expenses, it shall be displayed in profit and loss account as expenditure. Software cannot prevent incorrect grouping of ledger.